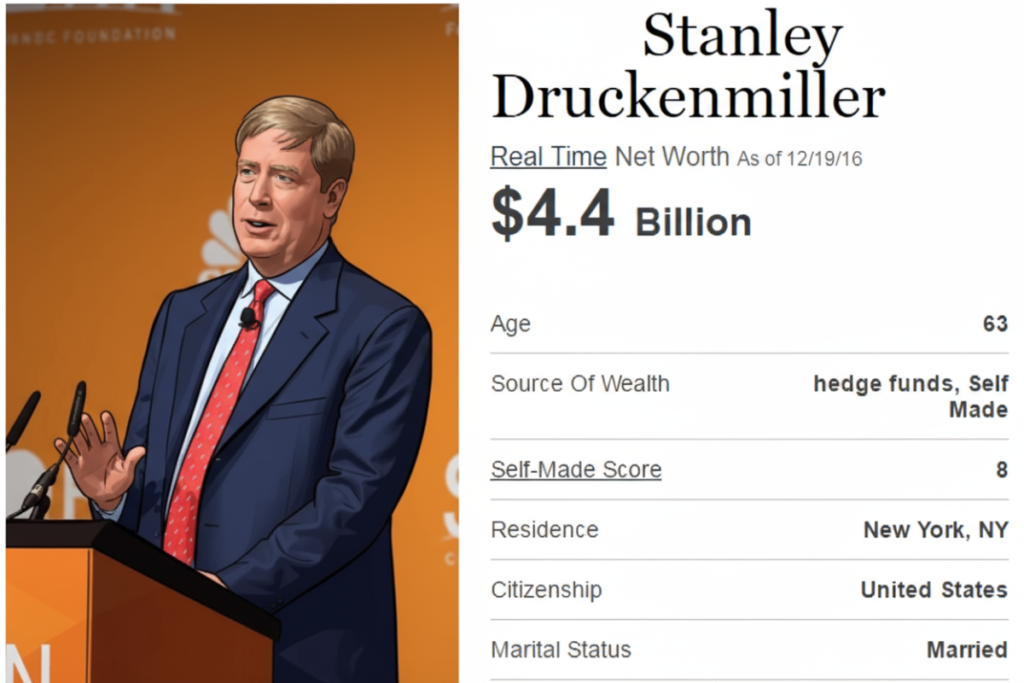

The Financial Genius Recognized by George Soros: Stanley Druckenmiller

Hello! I’m Michael from WStorybook.

Today, we’re diving into the life of a living legend: Stanley Druckenmiller. In the world of high-stakes investing, he is widely regarded as a “true investment genius.”

Interestingly, Druckenmiller isn’t a fan of diversification. His signature style is to concentrate 100% of his assets the moment he feels a surge of conviction. It’s a bold approach and it has made him one of the most successful investors in history.

Let’s explore the story of Stanley Druckenmiller.

✅ An Ordinary Boy Enters the World of Finance

Born on June 14, 1953, into a middle-class family in Pittsburgh, Pennsylvania, Druckenmiller spent his childhood moving between New Jersey and Virginia as his father, a chemical engineer, relocated for work. He also experienced the personal challenge of his parents’ divorce at a young age.

His academic path was surprisingly modest

He once confessed, “I’m no genius. My high school grades weren’t in the top 10%, and my SAT scores were average. That’s why I chose Bowdoin College. They didn’t require SAT scores for admission.”

However, when it came to investing, his genius was undeniable.

While at Bowdoin, Druckenmiller originally majored in English Literature with dreams of becoming a teacher. But a simple curiosity about how to read the financial section of the newspaper led him to take an economics class.

That elective changed his destiny. Captivated by the subject, he graduated in 1975 with a double major in Economics and English Literature.

After a brief stint in a PhD program at the University of Michigan, he dropped out, choosing the “real world” of finance over academia. In 1977, his legendary career began when he joined Pittsburgh National Bank as an oil analyst.

✅ The Discovery of Talent and the Birth of Duquesne Capital

Within just one year of starting as a trainee, Druckenmiller’s extraordinary insight earned him a promotion to head of the bank’s equity research group.

In 1981, at the age of 28, he struck out on his own to found Duquesne Capital Management. Initially starting with just $900,000 in capital, he faced lean years where operating expenses often outpaced profits. But he didn’t waver.

His unique strategy – blending macroeconomic analysis with highly concentrated bets- eventually caught the market’s attention.

By 1986, while also serving as head of the Dreyfus Fund, his success at Duquesne became impossible to ignore, eventually leading to a life-changing call from the legendary George Soros.

✅ The Meeting with Soros: The Trade That Broke the Bank

In 1988, George Soros recruited Druckenmiller as the chief portfolio manager for the Quantum Fund. This partnership would become one of the most profitable collaborations in financial history.

Under his management, the Quantum Fund achieved a staggering average annual return of 40%.

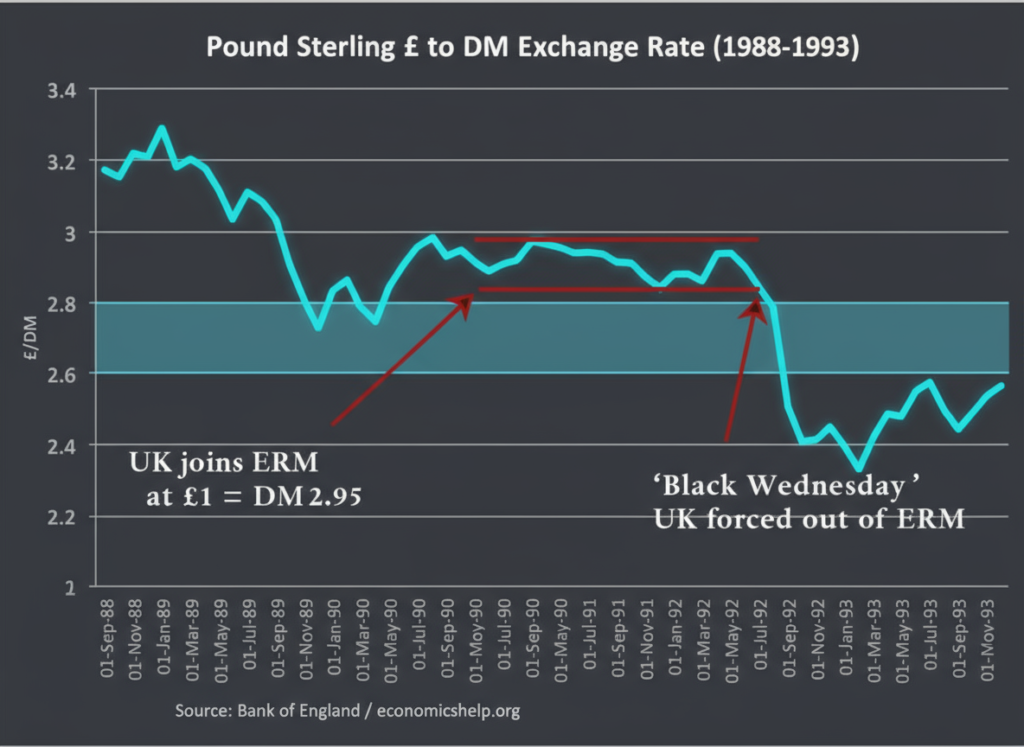

Druckenmiller’s name was etched into the history books on September 16, 1992 – a day known as “Black Wednesday.” Convinced that the British pound was overvalued, he proposed that they short 100% of the Quantum Fund’s capital against it.

Soros famously pushed him even further, reportedly saying:

“That’s lousy risk management. When you get a one-sided opportunity like this, you should bet 200%, not 100%.”

The result was a triumph. The British government failed to defend the pound, and the Quantum Fund netted over $1 billion in profit in a single day.

While the public knows Soros as “the man who broke the Bank of England,” Druckenmiller was the true architect of the trade.

✅ A 30-Year Unbeaten Record and Honorable Retirement

Even after leaving Soros’s side, Druckenmiller continued his unparalleled streak at Duquesne Capital. During the 2008 financial crisis, when most hedge funds were being decimated, he still managed an 11% return.

His career statistics are nothing short of phenomenal. For over 30 years, he maintained an average annual return of over 30% without a single losing year. If you had invested $10,000 with him in 1981, it would have grown to roughly $26 million by 2010.

In August 2010, at age 57, he closed his $12 billion fund and announced his retirement. His reason was deeply personal: “Managing clients’ money for 30 years has been a pleasure, but the emotional toll of the declines has started to outweigh the joy of the victories.”

He retired at the top of his game, while the applause was still ringing.

✅ Investment Philosophy: Conviction and Liquidity

Druckenmiller’s legacy is built on a few core principles:

- Invest in the “18-Month Future”

: Don’t look at a company’s current state. Look at where it will be 18 months from now. Stock prices follow the future, not the present. - Liquidity Moves the Market

: It’s not just earnings that drive stocks; it’s central banks and the flow of money. Always keep a close eye on the Federal Reserve. - The “Size of the Win” Matters Most

: It’s not about how often you are right or wrong. It’s about how much money you make when you are right and how effectively you minimize losses when you are wrong.

INSIGHT

We study the philosophies of legendary investors like Druckenmiller to find an edge in today’s volatile markets.

While we might not be able to replicate his results perfectly, his macro analysis and world-class conviction offer profound lessons for any investor.

In my next post, we’ll take a closer look at Druckenmiller’s current portfolio and the specific sectors he is betting on today.